Federal Tax Incentives and Co-op Rebates – 2024

Tax Incentives and Rebates for HVAC Systems – 2024

Tax Credits

What are tax credits in the world of HVAC? The federal government supports energy-efficient technology in residential homes and commercial buildings by offering tax credits. You can receive a credit toward the income tax you may owe if you purchase and install a qualifying energy-efficient HVAC system, such as a heat pump or certain AC units.

In terms of equipment, you can receive up to $2,000 as a credit when tax season arrives, particularly for systems like heat pumps, which qualify for a 30% credit. For more detailed information and to ensure your system qualifies, please visit the IRS website.

Utility Rebates

What are rebates in the HVAC world? Rebates are a useful tool to incentivize people to install energy efficient HVAC systems in your residential home or commercial building. Instead of being tax based and ran by the federal government, the rebates are rewarded by specific electric companies or Co-ops.

These groups also place high value on energy-efficient HVAC systems and want to assist buyers in financially affording these types of systems. Below, we will review more details on the types of units that are associated with rebates as well as the companies who offer them in our area.

North Carolina -

Haywood EMC Co-op – Haywood Electric does not provide rebates to its members currently. The offerings may change over time. Make sure to look again when you are planning on purchasing a new unit. For more information from Haywood, click the logo to go to their webpage.

South Carolina -

Laurens Electric Co-op – Laurens Electric offers rebates for installing energy-efficient systems such as heat pumps and AC units. Residential members can receive significant financial incentives to make their homes more energy-efficient. Earn rebates on Duct Work, Heat Pumps, Attic Insulation, AC and more. Click the logo to see your savings.

Duke Energy – When you click the link to their webpage, make sure to change your location to South Carolina. This can be found in the top right corner next to their search bar. Duke Energy supports the installation of energy-efficient HVAC systems through various rebate programs. These incentives aim to make eco-friendly technology more accessible to residential customers.

Little River Co-op – Little River Electric Cooperative currently does not offer specific rebates for HVAC systems. However, they are committed to promoting energy efficiency among their members. They provide resources and tips on energy efficiency to help members save on utility bills. Visit their website for updates.

Broad River Co-op – Broad River Electric Cooperative does not have direct HVAC rebate programs but offers various resources and tips on energy efficiency. They provide educational resources and initiatives to help members improve their home’s energy efficiency. They have initiatives like the Smart House to demonstrate energy-saving technologies. Check their website for more information and updates.

Sometimes we don’t pay attention to the things we are subscribed to or what companies we use as consumers. With that being said, if you’re unsure what Electric company or co-op you use, this tool might be helpful in figuring out – The Electric Cooperatives of South Carolina. This resource is great for residents of South Carolina. You can learn more about electric Coops of South Carolina on this page! For North Carolina residents looking for more information on energy efficiency and cooperative rebates visit NC Electric Cooperatives. This resource provides valuable information on local electric cooperatives and their initiatives to help you save energy and reduce costs.

Summary on Rebates

Rebates are provided by specific electric companies or cooperatives.

Eligibility varies by company, but typically includes energy-efficient systems like heat pumps and AC units.

Potential savings can be substantial, helping to offset the initial cost of new installations.

Tax Credits Summary

-

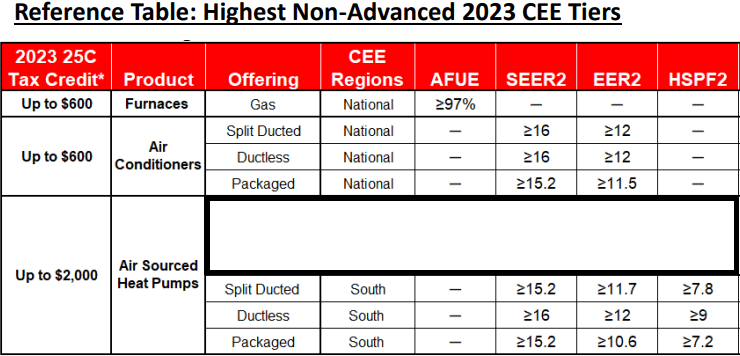

- Qualifying Systems: Includes air-source heat pumps, central air conditioners, and gas furnaces, among other energy-efficient HVAC systems recognized by the IRS.

- Credit Amounts: Homeowners can claim up to 30% of the cost, with a cap of $2,000 for heat pumps, $600 for central air conditioners, and $600 for gas furnaces.

- Purpose: Designed to make eco-friendly upgrades more affordable and to promote energy efficiency in residential homes.

- Claiming Credits: These tax credits can be claimed when filing your federal income tax return. Be sure to visit the IRS website for detailed eligibility criteria.

- Documentation: Keep all receipts and documentation related to the purchase and installation for tax purposes.

- Long-term Savings: Enjoy long-term savings on energy bills due to increased efficiency of the upgraded systems.

- Environmental Impact: Contribute to environmental conservation efforts by reducing your home’s carbon footprint.

SEER Ratings

The SEER rating of an HVAC system measures its efficiency—higher SEER ratings mean better energy efficiency. The federal government offers tax credits to encourage homeowners to install more energy-efficient HVAC systems.

To maximize your tax credits, ensure your new HVAC system meets or exceeds these efficiency standards. These credits are designed to offset the cost of upgrading to energy-efficient equipment, making it more affordable to lower your energy consumption and reduce your carbon footprint.

Clyburn Accounting Services LLC.

Wondering how to claim these credits? Bob Clyburn can help! Give him a call or visit his website.

Conclusions

Rebates and tax incentives play pivotal roles in promoting the adoption of energy-efficient HVAC systems. Local electric cooperatives like Laurens Electric, Haywood Electric, Little River Electric, Duke Energy, and Broad River Electric may offer rebates that can substantially reduce upfront costs for installations such as heat pumps and AC units. Currently, Laurens and Duke offer rebates to our knowledge. Companies change their policy over time so make sure to monitor their offerings.

These incentives not only help homeowners save on energy bills but also provide financial rewards for choosing energy-efficient options. Simultaneously, federal tax incentives offer up to $2,000 in credits for qualifying HVAC upgrades in 2024, encouraging long-term energy conservation and environmental benefits.

To take advantage of these incentives, homeowners must ensure their systems meet IRS energy efficiency standards and claim these benefits when filing their federal taxes. Together, these programs make upgrading to energy-efficient HVAC systems more accessible and cost-effective.

Look into stacking rebates and tax incentives if you can!